Before I look at the Salesforce numbers each quarter, I always fear it will be more of the same. Not the case this time around with more mixed signals than a Morse code operator with a hand tremor. We also have my predictions to weigh up so let us see how I fared.

The Numbers

I was asked last week if I make these numbers up. The answer is no. The majority come directly from Salesforce’s own website. The ‘earnings’ call transcripts I get from Seeking Alpha, Google statistics from Google Trends and the insider trade statistics from Yahoo (which get them from the SEC filings lodged by Salesforce). All I bring to the table is Excel’s graphing and trend analysis tools.

| 2014 Q3 | 2014 Q4 | 2015 Q1 | 2015 Q2 | 2015 Q3 | |

| Revenue | 1,076,034 | 1,145,242 | 1,226,772 | 1,318,551 | 1,383,655 |

| Subscription Revenue | 1,004,476 | 1,075,001 | 1,147,306 | 1,232,587 | 1,288,513 |

| Revenue Cost | 268,187 | 273,530 | 292,305 | 307,831 | 333,211 |

| Operating Cost | 905,778 | 975,458 | 989,808 | 1,044,154 | 1,072,486 |

| Salesforce Income | -124,434 | -103,746 | -96,911 | -61,088 | -38,924 |

| Highest Transaction | 2,037,819,946 | 2,502,030,346 | |||

| Transaction Growth qoq | 23% | ||||

| Revenue Growth # yoy | 287,636 | 310,561 | 334,139 | 361,457 | 307,621 |

| Revenue Growth % yoy | 36% | 37% | 37% | 38% | 29% |

| Revenue Growth % qoq | 12% | 6% | 7% | 7% | 5% |

| Total Cost % yoy | 39% | 46% | 37% | 36% | 20% |

| Staff | 12,770 | 13,312 | 14,239 | 15,145 | 15,458 |

| Staff Growth (yoy) | 37% | 36% | 38% | 20% | 21% |

| Margin | -11.56% | -9.06% | -7.90% | -4.63% | -2.81% |

| Growth Difference | -3% | -9% | 1% | 2% | 9% |

| Cash | 651,750 | 781,635 | 827,891 | 774,725 | 846,325 |

| Accounts Receivable | 604,045 | 1,360,837 | 684,155 | 834,323 | 794,590 |

| Cash/AR | 108% | 57% | 121% | 93% | 107% |

There is a new addition to the rows here with the ‘Highest Transaction’ row. This is taken from the trust.salesforce.com site and is the highest Transactions value shown for the date range at the time of writing. As discussed previously, the transaction count is my new basis for predicting an approximate user base for Salesforce. Quarter on quarter, transactions (and therefore subscribers) rose 23%. Nice work.

Staff growth is still low and is suggesting a new normal for Salesforce. The loss for the quarter was a mere $38 million which is the smallest it has been for about two years so also not a bad result.

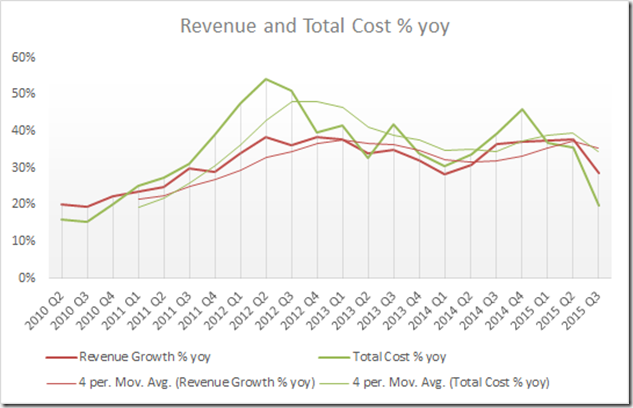

Revenue and Cost Growth

The big change is in Cost Growth. At an annual growth rate of 20%, this has practically halved, compared to recent quarters, and is close to the growth rates from five years ago. Marc has put the brakes on sales and marketing spending. This, in turn, has put a dent in Revenue Growth but not to the same level. Revenue Growth was down to 29% meaning Salesforce has reversed the trend of costs outpacing sales and, if they keep it up, means they can sustainably return to profit. This is reflected in the Growth Difference where we now see three quarters of positive difference (revenues accelerating away from costs). Another great outcome.

Here it is graphically.

Both Revenue Growth and Cost Growth have dropped but Cost Growth more so. The moving averages are now at about the same point meaning, if things progress as they are, we are moving from costs spiralling out of control to sustainable profitability.

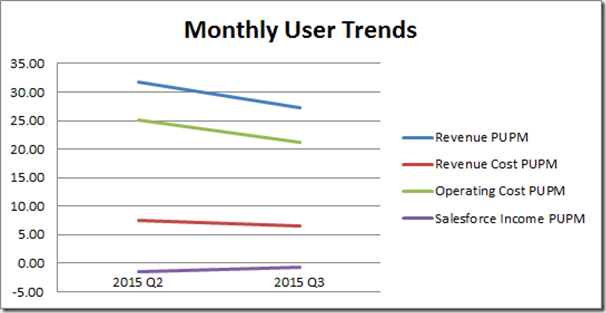

Subscribers

Using the formula derived previously, as mentioned, subscribers have grown 23% to around 17 million. In terms of how profitable they are, in line with the growth changes, we see a positive result.

The key line here is the bottom one. Income (profit/loss) is still negative (about -75c per user per month) but is trending in the right direction (it is about half of what is was last quarter) and could well be close to positive next quarter.

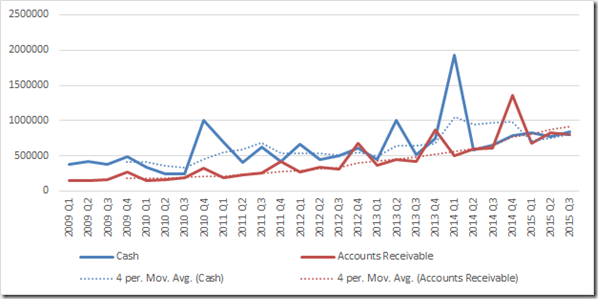

Cash and Accounts Receivable

The two remain entwined this quarter with Cash nudging slightly above Accounts Receivable. While this is good, it is too early to call this a win with the moving average remaining largely unaltered.

Earnings Call Buzzword Bingo

The rule is the words on the list have had ten or more mentions in the past five periods with the text used being the call transcript after the introduction and up to, but not including, questions.

| 2014 Q3 | 2014 Q4 | 2015 Q1 | 2015 Q2 | 2015 Q3 | |

| Number of words | 3700 | 3700 | 2400 | 4731 | 3922 |

| Customers/Customer | 39 | 25 | 22 | 38 | 34 |

| Revenue | 37 | 29 | 19 | 27 | 26 |

| Cloud | 31 | 14 | 15 | 22 | 47 |

| ExactTarget | 21 | 15 | 7 | 8 | 1 |

| Platform(s) | 21 | 12 | 10 | 13 | 27 |

| Service | 19 | 13 | 13 | 15 | 12 |

| Sales | 16 | 4 | 6 | 6 | 7 |

| Growth | 14 | 12 | 9 | 18 | 16 |

| Marketing | 12 | 11 | 5 | 10 | 8 |

| Cash | 10 | 16 | 10 | 11 | 9 |

| Mobile | 7 | 5 | 2 | 8 | 8 |

| Operating | 7 | 10 | 11 | 11 | 8 |

| Enterprise(s) | 7 | 3 | 8 | 10 | 8 |

| EPS | 5 | 6 | 6 | 6 | 5 |

| Salesforce1 | 0 | 11 | 6 | 7 | 7 |

| Dreamforce | 11 | 14 | |||

| Analytics | 14 |

This quarter we say goodbye to ‘Mobile’ and ‘EPS’ (Earnings Per Share). As to why Marc is no longer pushing his EPS statistics, I am not sure. The magical non-GAAP treatment is still turning a standard EPS loss into a non-standard EPS profit so why not? Could Marc be finally distancing himself from the black art of non-GAAP numbers?

Similarly, the push for mobile seems to have waned with “Cloud” and “Platform(s)” being the Salesforce catchcry of the quarter. In the case of both of these words, mentions literally doubled since the last call.

Salesforce, it seems, is no longer a social CRM and it is not a mobile app development tool; it is a cloud development platform.

The newcomer our list is ‘Analytics’. Now that Salesforce actually has some Business Intelligence tools in the form of the “Analytics Cloud”, it is doing its best to promote them.

The only word in danger of dropping off the Salesforce newspeak vocabulary list next quarter is “Sales”. The origins of Salesforce as a sales force automation tool are being lost as it diversifies to be more than just CRM.

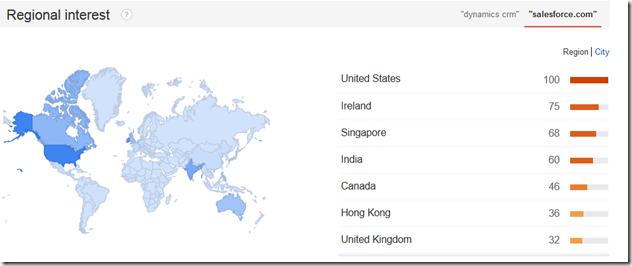

Google Trends

Nothing too surprising here. Salesforce continues to focus on North America, with Dynamics CRM being more spread across North America, Europe and Australasia.

Insider and Institutional Sales

I tweeted earlier this week about a significant shift in insider sales. Here are the numbers from Yahoo.

| 2014 Q3 | 2014 Q4 | 2015 Q1 | 2015 Q2 | 2015 Q3 | |

| Insider Sales | 0.50% | 0.50% | 0.50% | 0.40% | 4.70% |

| Institutional Sales | 2.75% | 2.72% | 2.71% | 2.67% | 3.20% |

Insider sales (sales of shares by the Salesforce executive) have jumped tenfold. I have often talked about the constant sales for shares by key figures such as the CFO but a tenfold increase in offloading in the previous six months of transactions is huge.

In fact, digging into the details, it is only one of the executive whose selling has caused this shift: Marc Benioff, CEO and Chairman. Marc used to sell a lot of shares, back in the old days, but had not sold too much for close to two years. Then, in June this year, something changed. Marc, between 9 June and 7 November offloaded something like 1.8 million shares (roughly worth $100m). Yahoo also tells us Marc has 39 million shares in Salesforce (about 6% of all the shares in the market according to the Salesforce financials) which means this little sell off was about 5% of his holdings.

I cannot guess why Marc has retained so little of his company or why he is striving to own less, when he speaks so positively about the future prospects of Salesforce and, in this quarter, the numbers show optimism.

Looking to the Future

Last quarter I predicted revenues of $1.4b (they were $1.38b) and a loss of $40m (it was 39m) so I am pretty happy with my work, especially with the predicted loss, which Salesforce predicted would be twice as high.

Next quarter I predict revenues of $1.46b-1.48b and a loss of around $20m (Salesforce predict $1.44b in Revenue and around $60m in loss)

Conclusions

Salesforce are fighting back to profitability and, if it was not for Marc offloading his ownership of the company, this would be a glowing report card for the company. Diversification of their product offering seems to be working and, if it is, it will become evident in the next couple of quarters.

Why Marc and other members of the executive continue to wax lyrical about the future of the company only to immediately sell their ownership of the company confuses me to no end. One possible reason is that they feel the price of the shares is too high and, even if Salesforce go from strength to strength, their money can be better invested/spent elsewhere. This is pure speculation, of course.

Profitability and sustainable growth has eluded Salesforce for years now. This quarter has been the first to give me hope that such goals are possible for them. The full year results and the next couple of quarters will confirm if my optimism is well founded.

No comments:

Post a Comment